The Neuberger Berman SRI Team, along with investors worth $3.6 trillion, is supporting the Joint U.S. and Canadian Announcement on Limiting Methane Emissions from the Oil and Gas Industry in a joint statement that can be found here.

Methane, the principal component of natural gas, makes up 10% of the total US GHG emissions compared with CO2 at 82%. Out of this 10%, natural gas and petroleum systems make up 29% of methane emissions, the largest source of CH4 emissions.1

At the downstream or plant level, natural gas burns with about 50% lower carbon emissions and with lower VOCs making it a cleaner alternative to coal The cleaner emissions characteristics and the higher heat content give natural gas a clear advantage over coal.

At the upstream or production level, natural gas operations release methane emissions, (which are estimated to be significantly more potent than CO2 emissions). In some cases, studies have shown that methane leaks erode some of that advantage when comparing the life-cycle analysis of gas vs. coal. For instance, a recent Environmental Defense Fund (EDF) study found that oil and gas emissions in the Barnett Shale in Texas, were almost twice that of official estimates.2

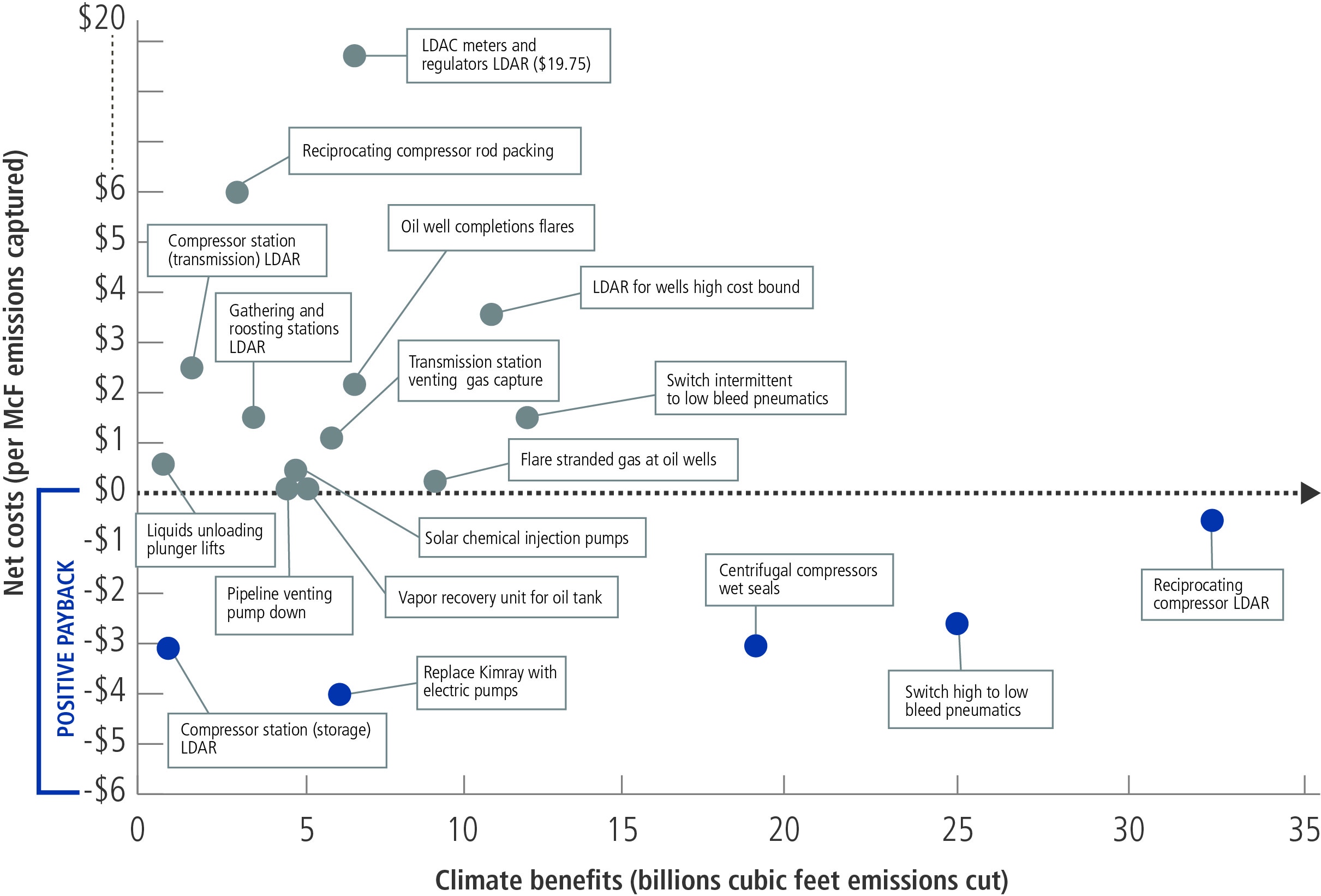

The good news is that many of these emissions are avoidable and cost-effective solutions already exist for the industry to reduce methane emissions during the production phase. In fact, a 2014 report by ICF International, a leading technical consulting firm with over thirty years of experience in the energy sector, found that by adopting already available technologies and operating practices, industry could cut methane emissions by 40% over five years for just one penny per thousand cubic feet of produced gas.3 To illustrate, the following graph highlights existing proven technologies, their climate benefits and net costs.

Proven Technologies

Source: ICF International

As SRI managers, and in keeping with our Statement on Climate change, we support efforts by businesses to reduce their environmental and emissions footprint.

We believe that the joint investor statement to support the U.S. and Canadian governments on limiting methane emissions from the oil and gas industry is consistent with our initiatives focusing on carbon and methane emissions reductions over the past several years including engagement on this topic with our relevant holdings.

- In September 2015, along with industry colleagues, we hosted a discussion on climate change issues including carbon asset risk, carbon pricing and methane regulation. Apache Corp, Noble Energy, two independent oil and gas exploration and production companies, and BHP Billiton, a mining and diversified natural resource company, presented and provided valuable insights. The session was well attended and included internal as well as external investors and research analysts.

- In February 2015, we hosted a panel presentation with leading environmental policy experts to better understand what the upcoming federal methane policy could mean for the U.S. oil and gas industry and its investors. The panel included speakers from the Environmental Defense Fund (EDF), ICF International and CDP. NB SRI Portfolio Manager, Ingrid Dyott, moderated the panel. The diverse audience included internal as well as external investors and research analysts.

- White paper on Carbon Footprint Analysis. Assessing carbon impact from a broad perspective can provide valuable investment insights – NB SRI Group 2015

- White paper on Energy, the Environment and the Investment Process – NB SRI Group 2014.

- In 2014, we engaged the EPA to thoughtfully consider cost effective strategies for reducing methane emissions in oil and gas production.

- In 2013, Neuberger Berman joined the CDP Carbon Action request to implement cost-effective emissions reductions.

- Neuberger Berman has been a member of the CDP since 2004.